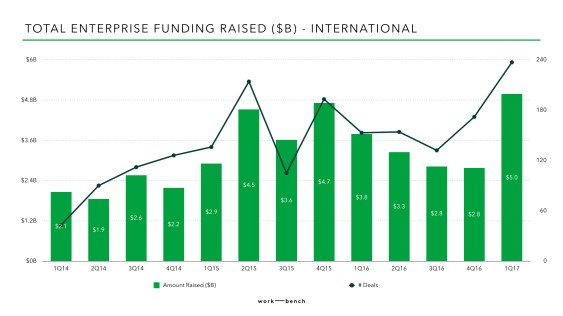

After a lackluster year for enterprise technology venture capital investments, 2017 kicked off with a record breaking quarter for enterprise technology startups.

Following 4 straight quarters of decreasing investment, investors poured a record-breaking $5 billion dollars into enterprise technology startups in the first quarter of 2017 alone – a nearly 80% increase from the previous quarter – across a record number of 237 deals.

These enterprise startups – solving problems for world’s largest companies around data & analytics, cloud-native infrastructure, cybersecurity, and AI-powered business applications for the future workplace – are building businesses by capturing some of the close to $3.5 trillion that the Global 1000 and Fortune 500 spend every year on software and technology.

And they’re having a moment. Coming on the heels of Cisco’s massive $3.7B acquisition of AppDynamics right before their public offering earlier this year – and MuleSoft’s 45 percent pop on their first day of trading two weeks ago – enterprise is clearly in vogue.

With Alteryx’s IPO last week, there’s still a robust lineup of enterprise exits coming down the pipeline, including Presido, Okta, and Yext, who have all filed S-1s in preparation of an IPO, and speculation from many more including Cloudera, DocuSign, Domo, and Tenable Network Security.

As a venture fund focused exclusively on enterprise technology, we’ve been following these numbers closely at Work-Bench. Using data from our publicly available Enterprise Startups Funding Database – where every week we track and record all publicly announced enterprise technology funding rounds – we took a look at the record-breaking 237 deals completed in Q1 2017.

After a lackluster year for enterprise technology venture capital investments, 2017 kicked off with a record breaking quarter for enterprise technology startups. Following 4 straight quarters of decreasing investment, investors poured a record-breaking $5 billion dollars into enterprise technology startups in the first quarter of 2017 alone – a nearly 80% increase from the previous quarter – across a record number of 237 deals.

These enterprise startups – solving problems for world’s largest companies around data & analytics, cloud-native infrastructure, cybersecurity, and AI-powered business applications for the future workplace – are building businesses by capturing some of the close to $3.5 trillion that the Global 1000 and Fortune 500 spend every year on software and technology.

And they’re having a moment. Coming on the heels of Cisco’s massive $3.7B acquisition of AppDynamics right before their public offering earlier this year – and MuleSoft’s 45 percent pop on their first day of trading two weeks ago – enterprise is clearly in vogue. With Alteryx’s IPO last week, there’s still a robust lineup of enterprise exits coming down the pipeline, including Presido, Okta, and Yext, who have all filed S-1s in preparation of an IPO, and speculation from many more including Cloudera, DocuSign, Domo, and Tenable Network Security.

As a venture fund focused exclusively on enterprise technology, we’ve been following these numbers closely at Work-Bench. Using data from our publicly available Enterprise Startups Funding Database – where every week we track and record all publicly announced enterprise technology funding rounds – we took a look at the record-breaking 237 deals completed in Q1 2017.

Looking at geography data and funding raised by individual states, California is the clear leader. Since 2014 through, New York has established itself the definitive number two hub for enterprise technology in the United States with its unparalleled proximity to Fortune 500 customers and diverse range industry buyers spanning financial services, pharmaceuticals, media, insurance, and telecom giants. Massachusetts did have a strong Q1 though, narrowly beating out New York for second place with $471M raised compared to $446M raised. Massachusetts’ growth was buoyed by large later stage deals that included Fuze’s $104M Series E, Kaminario’s $75M Series F, DataRobot’s $54M Series C, and Kensho’s $50M Series B.

New York meanwhile had two $50M rounds from Namely’s Series D and Collibra’s Series C, but the majority of rounds came from Seed through Series B startup, which bodes well for the city’s continued momentum in the early stage ecosystem. Given the number of mature companies who will likely raise in 2017 as well, New York will likely regain control over Massachusetts in the next quarter or two to finish the year in second place behind California.

Other notable deals included Singapore-based datacenter company AirTrunk’s $400M venture round from Goldman Sachs, automated application testing company Tricentis’ $165M Series B, connect smart machines platform ClouldMinds’ $100M Series A, and real-time data streaming Confluent’s $50M Series C. Congrats to all these great companies on a record breaking quarter for enterprise technology.